After a productive 2014 tax season–with almost 3,400 clients served at no charge and more than $5.3 million in refunds garnered–MEDA’s seemingly tireless Free Tax Preparation staff and 120 volunteers were a bit worn down. Unfortunately, so were some of the tax department computers.

After a productive 2014 tax season–with almost 3,400 clients served at no charge and more than $5.3 million in refunds garnered–MEDA’s seemingly tireless Free Tax Preparation staff and 120 volunteers were a bit worn down. Unfortunately, so were some of the tax department computers.

Action was needed to get these laptops refurbished for the reminder of 2014 and in anticipation of next year’s January to April tax season and its historically high demand.

A request for quote was put out to IT companies, with the average cost of $250-300 to refurbish each of these 17 computers. That $5K cost was a bit steep for a nonprofit, so the tax team faced a dilemma.

MEDA’s Technology Training Coordinator Leo Sosa heard of the issue and came up with a solution.

Sosa is involved with the free young adult programs at MEDA, with one such program being the Mission Techies. In this pioneering workshop, underserved youths are given the opportunity to learn IT skills so that they can be put on the path to a career in that continually expanding industry.

Explains Sosa, with the exuberance of a proud parent, “Two recent placements of graduates in the IT field confirms that this program is working. We are seeing outcomes. I was glad to offer the services of these Mission Techies to the hard-working MEDA tax team.”

Sosa’s curriculum includes the Mission Techies refurbishing computers for financially challenged community residents—an initiative that has led to 80 smiling faces as relieved clients walked out the doors of Plaza Adelante with a functioning computer to stay connected at home.

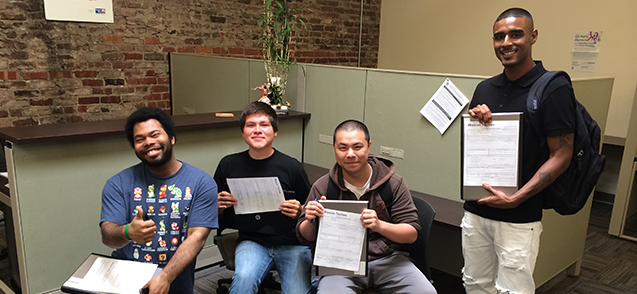

So, the idea was to have this Cohort #3 of the Mission Techies tackle the issues of the tax computers, with such work exponentially aiding the community. Think of it as social enterprise: an organization applies commercial strategies to optimize improvements in the community rather than for profit.

The task for the Mission Techies was comprehensive, including updating everything from operating systems to Microsoft Word.

States Moy-Borgen, pictured with Mission Techie Andrea Mejia, “MEDA’s tax team is so impressed with, and grateful for, the work of the Mission Techies. They were able to bail us out of a very sticky situation, as our laptops were outdated with Windows XP and Microsoft has since officially ended support service for it. Luckily for us, the Techies were able to do this valuable service for us free of charge, all while learning new skills. I was surprised and humbled that while they provided this incredible service to us, they were thanking me for the opportunity to help and learn new skills, when I felt I should have been thanking them.”

States Moy-Borgen, pictured with Mission Techie Andrea Mejia, “MEDA’s tax team is so impressed with, and grateful for, the work of the Mission Techies. They were able to bail us out of a very sticky situation, as our laptops were outdated with Windows XP and Microsoft has since officially ended support service for it. Luckily for us, the Techies were able to do this valuable service for us free of charge, all while learning new skills. I was surprised and humbled that while they provided this incredible service to us, they were thanking me for the opportunity to help and learn new skills, when I felt I should have been thanking them.”

A bright future lays ahead for Cohort #3. Affirms Moy-Borgen, “I have no doubt that each and every one of this group have a bright future, as they have already accomplished so much in a short time frame.”

Tax Site Coordinator Owen Thompson also breathed a sigh of relief that the Mission Techies had offered a solution to the tax department’s problems.

Thompson explains, “The work of the Mission Techies saved us money that we can now put into free tax preparation for our community. The fact that these young men and women got new skills and experience in the process makes this a real win-win.”

These 17 laptops are now primed to assist 2015’s tax clients . . . as are MEDA’s tax team and volunteers.

Problem solved.

If you are a nonprofit interested in computer services from the Mission Techies, please contact Leo Sosa at (415) 282-3334 ext. 105; tech@medasf.org.