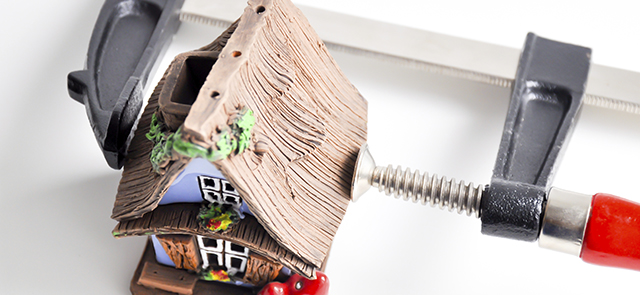

You may think issues around nefarious predatory lending from a few years back (aka the “Great Recession”) have all but disappeared. MEDA knows this is definitely not the case, as each week a number of clients still come to its Homeownership program for foreclosure assistance.

You may think issues around nefarious predatory lending from a few years back (aka the “Great Recession”) have all but disappeared. MEDA knows this is definitely not the case, as each week a number of clients still come to its Homeownership program for foreclosure assistance.

“We still see people in trouble from predatory-lending practices. These loans have not all been cleaned up and the banks will not always work with the client. We try to help any way we can,” explains MEDA’s free Homeownership Program Manager Vincent Alvarenga.

San Francisco Cares, an organization with a mission to take “community action to restore equity and health,” knows that in the poorer southeastern quadrant of the city the number of homes with issues ranges from 100 in zip code 94124, 85 in zip code 94112 and 52 in zip code 94134. Not surprisingly, the residents most affected are disproportionately people of color. These dire numbers were calculated by the Alliance of Californians for Community Empowerment (ACCE).

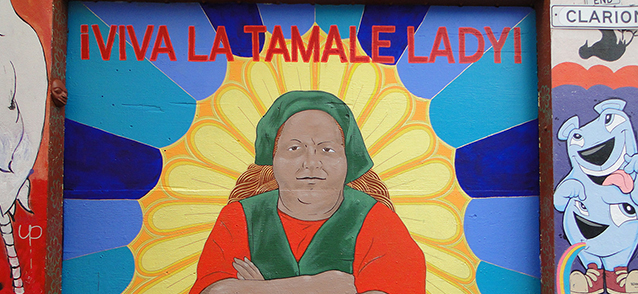

A high-profile client from MEDA’s Business Development program has recently showcased this continuing problem. You may not know her personally, but you’ve likely heard of a budding, Latina entrepreneur named Virginia Ramos. Still not sure who she is? She is better known as “The Tamale Lady.” Yep, that’s Virginia.

Business Development Coach Sabrina Haman has been helping Virginia get her business going, with a proper storefront in the Mission, after years of selling on the street or even in local bars. Virginia’s tamales are legendary, so marketing has been a definite success. The only thing needed is a rental space and permits. Kudos to the Mission Housing Development Corporation (MHDC) for helping in this regard, as an October 1st opening is now in the offing.

Except for one other thing: Virginia’s personal finances still need be addressed.

It seems that Virginia was the victim of a predatory loan for the purchase of a four-unit building on 24th Street in the Mission.

It seems that Virginia was the victim of a predatory loan for the purchase of a four-unit building on 24th Street in the Mission.

Virginia, a senior citizen and mother of seven looking to leave her children the legacy of a place to live in the Mission, had scrimped in the hope of being able to afford a property in her long-time neighborhood. She wasn’t looking to flip the property to make a quick profit. She simply wanted a home. So, when an opportunity presented itself, Virginia jumped at the opportunity . . . only to fall victim to an unscrupulous predatory lender.

Virginia doesn’t fit the profile of most folks buying homes in San Francisco. She is simply a small-business owner who wants to live in the neighborhood in which she works, making her a “community landlord”–someone that empathizes with tenants.

“The Tamale Lady” doesn’t drive a fancy car. Her clothes are hardly Armani suits. She doesn’t even eat at high-end restaurants on nearby Valencia Street.

All units are rent controlled, with many Section 8; rents have never been raised.

With loan issues compounded by a lack of income, Virginia was compelled to turn to her nephew to offer pro bono handyman services in an attempt to keep the building updated. As the edifice was older, this became tougher and tougher to do.

The dearth of earnings occurred when the Health Department swooped in and evidenced disdain for the famed “trashbag” tamales. The result: Virginia could no longer sell at Zeitgeist, the popular Mission bar. District 9 Supervisor David Campos immediately launched a fundraiser to help, but the damage had been done and the loss of revenue was severe.

Virginia had tried to fix her loan issue on her own starting in 2010, when a balloon payment came due. No luck.

It seems Virginia’s case was particularly reprehensible. The mortgage broker got a portion of the loan money from out of state, but the latter never received the money back from that mortgage broker. This out-of-state lender then decided to take out a $100,000 lien on Virginia’s property. None of this was her fault—she was the victim of the banking system.

Always there to help residents in distress, MEDA took action on its client’s behalf. Haman connected Virginia to a reputable lawyer with experience in these types of predatory loan situations. This indefatigable attorney, Samer Danfoura of Danfoura Law Offices, has been working to right a wrong, with this process almost complete. Virginia is finally on the road to personal fiscal health and will be able to open her business according to plan.

While Virginia’s situation is being resolved, there are still way too many members of the community who are having issues from predatory loans. With statistics like those from ACCE–as evidenced by Virginia’s case–there is plenty of work remaining to do to end this nightmare for far too many San Franciscans.

Sadly, the problem continues in 2014.