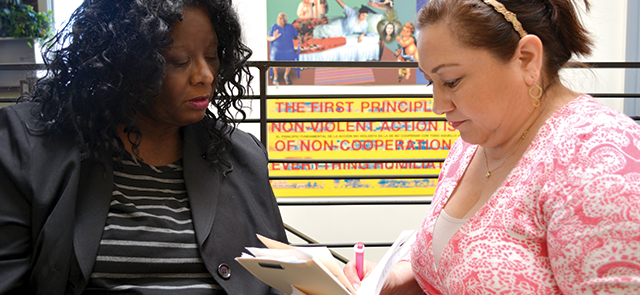

Today is the perfect time to take a breather from our hectic lives to reflect on things for which to be thankful. De De Tillman (photo, left) and her daughter, Marilyn, won’t have to reflect too long, as they are quick to tell everyone that they are thankful for their newfound financial security, achieved with the assistance of MEDA’s free, one-on-one financial coaching.

Today is the perfect time to take a breather from our hectic lives to reflect on things for which to be thankful. De De Tillman (photo, left) and her daughter, Marilyn, won’t have to reflect too long, as they are quick to tell everyone that they are thankful for their newfound financial security, achieved with the assistance of MEDA’s free, one-on-one financial coaching.

De De has the gift of gab and an ebullient personality. That was not always the case.

“It’s great to see De De shine. When she first came to MEDA, she didn’t walk with such a spring in her step,” explains MEDA Financial Capability Coach Teresa Garcia (photo, right), who has counseled De De for over a year.

Increasing savings

Garcia started De De on a savings plan. She advised her client to write down everything—and that means every single thing—purchased each day. That even includes smaller items such as a pack of gum. It all adds up. In De De’s case, $70 per week was being spent just on snack items.

De De got to work, knowing there was much to do, as just $25 sat in her savings account.

Today? $5,200. Plus another account for housing that is $2,100 (with the hope of a future condo purchase). A Roth IRA with $7,500. Even a business account with $3,000, as De De and her daughter, Marilyn, who is also a MEDA client, want to start an entertainment business, making films about cultural diversity.

“De De did the work from Day 1. She heeded my advice and has never looked back,” states Garcia.

How was this saving achieved? For one, De De and a number of fellow tenants had been wrongfully evicted and a class action lawsuit netted her some cash. Whereas she would have spent this in the past, this payout was all saved.

The second way happens each payday. The plan is to transfer money from her checking account into the general savings account, done immediately when De De’s direct deposit, from her job of 19 years as a Holiday Inn operator, shows up in the bank.

“I now pay myself first. Then I don’t miss the money,” states De De.

Then there’s the jar—a juice jar, to be exact, which is used for spare change. You see, whenever De De breaks a $20, any singles are taken to the bank to be put into the savings account and any change goes into that jar. The latter action translated into $69 from a recent haul, the coins then carefully rolled and put into savings.

Then there’s the jar—a juice jar, to be exact, which is used for spare change. You see, whenever De De breaks a $20, any singles are taken to the bank to be put into the savings account and any change goes into that jar. The latter action translated into $69 from a recent haul, the coins then carefully rolled and put into savings.

“This jar fills up fast. Even change Marilyn and I find on the street gets put in that jar,” explains a smiling De De of her savings strategy.

Improving credit

Like many MEDA clients, De De also had a credit issue when she first stopped by Plaza Adelante in the Mission. Coach Garcia set her client up with a Secured Credit Card. This is not your typical credit card: you put a minimum of $200 of your own money on the card, which becomes your line of credit, then you make payments on time each month.

There was also the issue of erroneous items on De De’s credit report. A medical bill showed as past due despite the fact that it was paid long ago. A Comcast line item claimed that a DVR was never returned, although De De had a receipt showing she had brought back the device. There were even some issues because of a stolen credit card from years ago. Once Garcia became aware of these issues, they were immediately addressed.

The result is that in just a year’s time De De now has a 720 credit score.

Garcia delivered the news of this now-healthy credit score to De De on the client’s 60th birthday last month. A great present, indeed.

Impending housing

Since being illegally evicted from her apartment, De De and her two grown daughters have been compelled to dwell in a hotel, sharing cramped quarters and just one bathroom. It’s been tough, but De De and Marilyn have a plan: they are looking to buy a below-market-rate unit (BMR) in San Francisco.

To help this happen, Garcia connected the family to MEDA Housing Opportunities Coach Johnny Oliver. Now that De De’s credit score is good, Oliver can help make this a reality (Marilyn already had a great credit score, the senior at San Francisco State working two jobs and being guided by MEDA Financial Capability Coach Laura Ospina-Jaramillo.)

For a downpayment, there’s that aforementioned housing savings account now at $2,100 and growing. There’s also that large Roth IRA; while De De knows better than to deplete these funds, she’s aware that it will make her look better to lenders. There is also San Francisco’s Downpayment Assistance Loan Program (DALP).

“Things are looking up. This would never have happened without MEDA’s help!” sums up De De on why she is grateful this Thanksgiving. Together, she and MEDA have found the recipe for family economic success.

If you are interested in free financial capability workshops, please contact us: (415) 282-3334 ext. 101; financialed@medasf.org.

Leave a reply