De De Tillman is a friendly woman, with an energetic gift of gab that keeps you hanging on every word.

De De Tillman is a friendly woman, with an energetic gift of gab that keeps you hanging on every word.

“I am a second cousin to Aretha Franklin. I’ve never met her though, and I can’t sing,” she starts off upon meeting her.

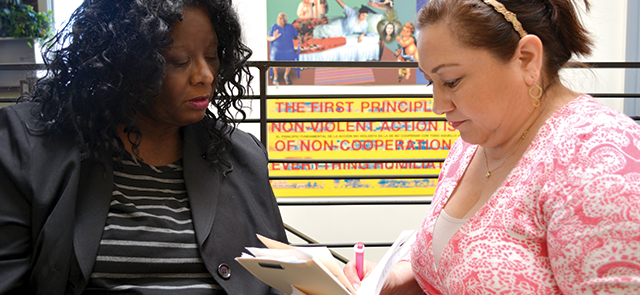

De De (photo left) has been coming to MEDA’s Plaza Adelante, the Mission neighborhood center, for a few years, solely to get free tax preparation. She came back this year to Taxes Plus: Go Further with MEDA, figuring she would just come in to get her taxes done for the 2014 calendar year. Little did she realize she would soon be heading down a new financial path.

It seems that while at Plaza Adelante, De De heard about the popular, free Financial Capability workshops held each Wednesday in the second floor computer labs. Finally admitting to herself that it was time to get real and put her fiscal house in order, De De signed up for a class taught by Financial Capability Coach Teresa Garcia (photo right).

Sitting in Garcia’s class, being taught the need to keep a budget, De De had to acknowledge that she had never done so. She also had to acknowledge that she needed help, so she asked Garcia to sign her up for one-on-one coaching.

Explains De De, “I work near my apartment at the Holiday Inn Civic Center as an operator and get direct deposit for my paychecks. I would snatch all the money and, before I knew it, all was spent. Sure, I made sure my rent was paid, but I had no idea where the rest went.”

Garcia explained to De De’s class that even If you buy a piece of bubblegum, you need to write it down. Garcia knows how much is spent on such small items, which adds up over time.

In De De’s case, that meant $21 a week spent just on peanuts and soda. That’s over $80 a month—too much for someone on a tight budget.

De De sprung into action, immediately implementing the following changes:

- No cable

- No subscriptions

- Buying items in bulk

- Drinking water rather than soda

- Keeping a change jar for pennies, nickels and dimes

De De also enrolled in her bank’s “Keep the Change” plan, whereby debit card purchases are rounded up to the nearest dollar, with the difference transferred into a savings account.

The result to date? $436 is now in De De’s savings account in just one month.

Continues De De, “I now get $25 from the first of the month’s paycheck automatically put into my savings. Once there is $2,500 in savings, I will start an investment plan for retirement. I opened a Roth IRA to be ready for that time.”

De De also had credit card issues. She had a 500 credit score because her credit card had been stolen a few years ago; there are still erroneous items to be cleared up. Garcia worked with De De to generate letters to send to the three major credit score companies to clear up the mess.

Sums up De De about her experience so far, ”Teresa is very knowledgeable and has the sweetest disposition. She talks to you, not at you. Teresa never judged my situation. She just made it like we are going to fix this together.”

Garcia says of her new client, “I admire De De’s tenacity and discipline to get her finances in order. In one month, she’s made more progress than many clients make in a few months. I can’t wait to see how far she goes in meeting her financial goals.”

If you are interested in free financial capability workshops, please contact us: (415) 282-3334 ext. 101; financialed@medasf.org.

Leave a reply