Our Mission

for the Mission

Rooted in San Francisco’s Mission District, MEDA is advancing a national equity movement by building Latino prosperity, community ownership and civic power.

Adelante. Since 1973.

MEDA is building Latino prosperity, community ownership and civic power. Our proven models are being recognized and shared locally, statewide and nationally. #MisiónUnida

MEDA’S FREE Programs Build Latino Family Prosperity

Get answers to all of your questions about MEDA’s free programs.

FAQs

Quality housing is for ALL San Franciscans. We preserve and produce affordable housing.

Community

Real Estate

Free workshops and coaching as you get ready to buy your first home or prepare to rent a below-market-rate (BMR) apartment.

Housing

Opportunities

It’s time to decrease debt, increase income and savings, and better your credit. MEDA can coach you — for free.

Financial

Capability

Why pay to have your taxes prepared? Maximize your refund or get an ITIN — for free.

Free Tax

Preparation

Free workshops and one-on-one coaching to start or expand your small business.

Business

Development

Can’t get a loan at a traditional bank? Start or grow your small business with a Fondo Adelante low-interest loan from MEDA.

Fondo

Adelante CDFI

Mock interviews. Help with your resume. Making connections. We offer free training and coaching so you can land a good job.

Workforce

Development

FREE training program for IT support careers.

Mission Techies

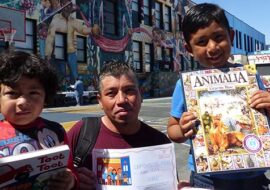

MEDA is the lead agency for Mission Promise Neighborhood — a community of 15+ partners that connects families to free services in the Mission.

Mission Promise

Neighborhood

The latest news from San Francisco’s Mission District

Flor de Oaxaca: Turning Challenges into Opportunities with Equitable Access to Capital

- March 29, 2024

- jmesa

"I had to be my own boss, I clung to the idea of opening my own business," explains Nayeli Bustamante, proprietor of Flor de Oaxaca, a ...

Financial Literacy Tools that Can Help Families Break the Cycle of Inherited Poverty

- March 25, 2024

- jmesa

Members of the community can make a start on building generational wealth by taking advantage of the free resources offered by the State Tre ...

When Families Thrive, Children Succeed: How MEDA Created a Transformational Prenatal-to-Career Model

- March 19, 2024

- jmesa

Harvard's EdRedesign documented MEDA’s development and impact in this case study ...

Click to see what the media are saying …

Read our 1,000 press mentions.